trust capital gains tax rate australia

The family trust capital gains tax Australian family trusts do pay capital gains tax CGT. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

Get more tips here.

. You must then work out five-tenths of the capital gains tax which is 28125. What is the capital gains tax rate on a trust. 2022 Long-Term Capital Gains Trust Tax Rates.

However long term capital gain generated by a trust still. Any income between 80000 and 180000 is charged at a marginal tax rate of approximately 37. Taxation of Capital Gains.

Australia Corporation Capital Gains Tax Tables in 2022. Download 99 Retirement Tips from Fisher Investments. Calculating your CGT Use the calculator or steps to work out your CGT including your capital proceeds and cost base.

In this case the trust gets taxed at the highest marginal tax rate 47. As part of the trusts net income or net loss the trust has to. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Will Wizard Australia Pty Ltd. Will Wizard Australia Pty. What is the capital gains tax rate on a trust.

Benefit 2 Discount on Capital Gains Tax for Disposal of Assets. For a non-resident company beneficiary that is not a. Complete a Capital gains tax schedule 2022 CGT schedule if you.

One of the tax advantages of a family trust is related to Capital Gains Tax CGT. By comparison a single investor pays 0 on capital gains if their taxable. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. Namely the 50 CGT discount. The trust deed defines income to include capital gains.

If a trust asset is sold and a gain is realized triggering a capital gains tax obligation that gain must be reported on the Settlors personal tax return. Otherwise the trustee is taxed under s99 rates which are as follows. 2022 Long-Term Capital Gains Trust Tax Rates.

If there is no trust income the trustee is taxed on any net income. Ad Tip 40 could help you better understand your retirement income taxes. For trusts in 2022.

Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250. Are a company trust attribution managed investment trust AMIT or superannuation fund with total capital gains or. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates.

2013-2014 s99 tax rates Share of net income Tax on Column 1 on excess 416 Nil 50 670 127 19 37000 7030. Find out if your asset is eligible for the 50 CGT discount. The trustee is generally taxed on the trust income at the highest marginal rate that applies to individuals except for some.

Rate of tax The rate of tax that a trustee pays in relation to a non-resident individual beneficiary that is not a trustee are at marginal rates. By default the trustee is assessable for tax on trust income for which there is no beneficiary presently entitled at the top marginal tax rate which is currently 45 47 in the. Australia Corporation Capital Gains Tax Tables in 2022.

The tax-free allowance for trusts is.

What Happens To A Family Trust If The Trustee Dies Linda Alexander Law

The Family Trust Tax Rate Explained Set Ups Benefits

What Are The Tax Advantages Of A Trust Legalvision

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

What Are The Tax Advantages Of A Trust Legalvision

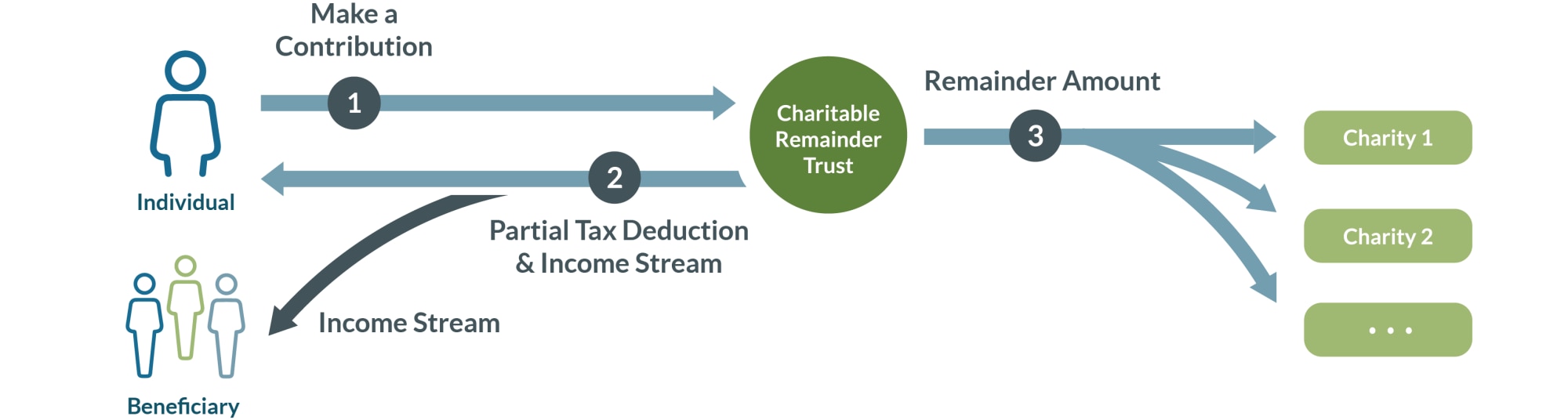

Charitable Remainder Trusts Fidelity Charitable

Investment Banks For Sale Is A Licensed Investment Bank And Statutory Trust Specialized In Assisting Entrepreneurs A Investment Banking Offshore Bank Investing

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

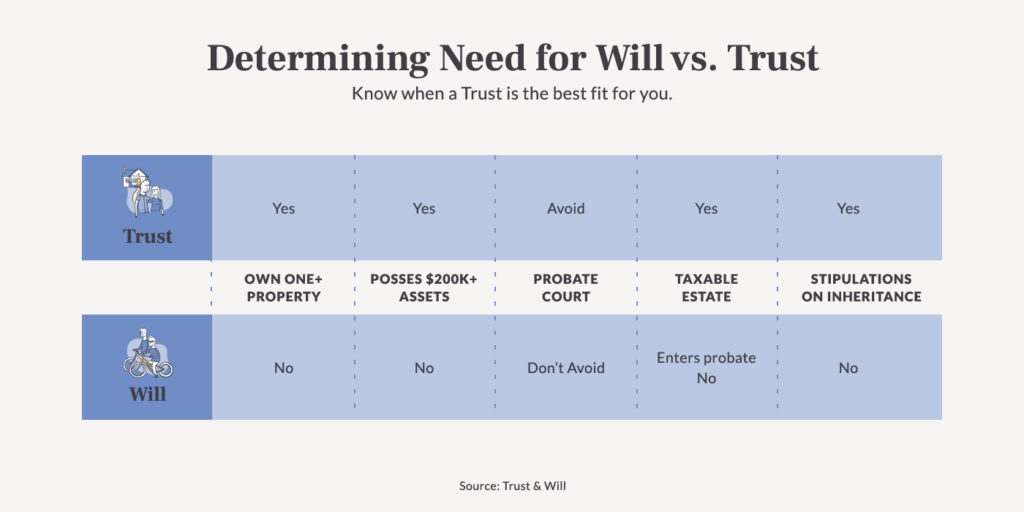

What Is A Trust In Estate Planning Trust Will

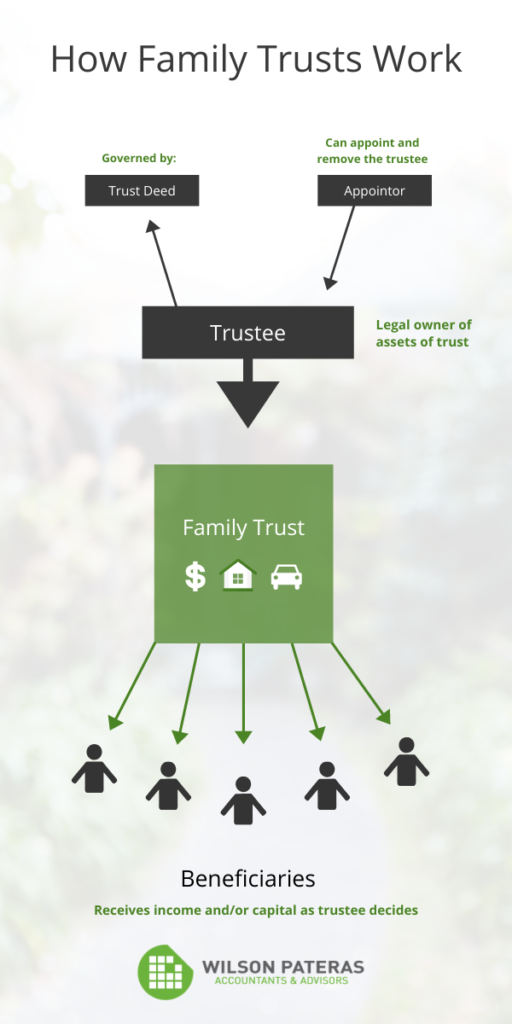

Family Trusts What You Need To Know

Income Tax Return Filing Is Required For Every Individual Company Partnership Firm Trust And Every Oth Income Tax Return Filing Income Tax Return Tax Return

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Are The Advantages And Disadvantages Of Family Trusts

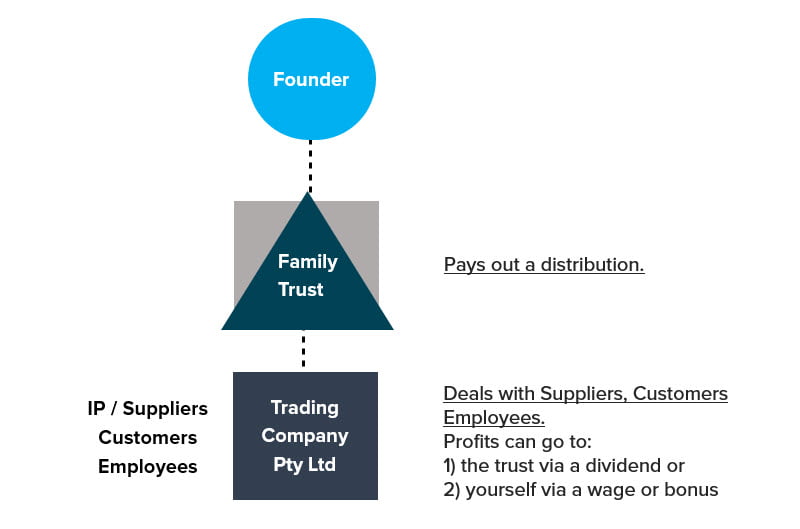

Including A Family Trust In Your Business Structure Fullstack Advisory

What Are The Basic Tax Returns In Australia Tax Refund Income Tax Return Tax Return